15/01/2026

Gambling debt can feel like a huge burden, leading to significant financial strain and emotional distress. It’s important to recognise that recovery is possible and that numerous resources and strategies are available to help you regain control.

This guide provides practical steps and financial management techniques for those struggling with gambling debt.

Understanding the Impact of Gambling Debt

Gambling harm can lead to debts. It’s common for individuals to borrow money from multiple sources, including credit cards and personal loans. This can lead to a vicious cycle, where money is borrowed to cover losses or fund existing gambling habits. The first step is to assess the severity of your gambling debts.

Taking Back Control: Financial Strategies for Debt Management

1. Develop a Realistic Budget

A budget helps you understand where your money comes from and where it goes, enabling you to spot areas you can reduce and allocate funds to debt repayment.

- Carefully record all sources of income and outgoings for at least a month to gain a clear picture of your financial flow.

- Differentiate between needs (housing, food, utilities) and wants. Ensure that essential bills are paid first, and then you can look at the rest.

- Once essential expenses are covered, dedicate a significant portion of your remaining income to debt repayment. Aim to pay more than the minimum on credit cards and loans, as minimum payments often prolong the debt cycle.

2. Prioritise Debts Effectively

Not all debts carry the same level of urgency or consequence. Prioritising debts can help you manage them more efficiently.

- Priority Debts: These are debts with the most serious repercussions if left unpaid, such as mortgage/rent, council tax, utility bills, court fines, and child maintenance. Failure to pay these can lead to loss of home, essential services, or legal action.

- Non-Priority Debts: These typically include credit card debt, personal loans, and store cards. While important, the immediate consequences of missing payments are generally less severe than those of missing priority debt payments.

3. Engage with your Bank and Creditors

It can feel daunting to contact your bank or creditors, but this can be really helpful. They may be able to offer support and solutions tailored to your situation.

- Contact Your Bank: Your bank may offer gambling transaction blocks that let you prevent payments to gambling companies. They might also be able to set limits on cash machine withdrawals and stop sending you credit offers.

- Speak to Your Creditors: If you are struggling to make repayments, tell your creditors. Many have specialist teams trained to help customers with financial difficulties due to gambling harm. Demonstrating your commitment to addressing the gambling issue can make them more willing to help you establish an affordable payment plan.

Breaking the Cycle: Strategies to Stop Gambling

Addressing the underlying gambling behaviour helps stop further debts from accumulating. Implementing barriers and seeking support are essential.

Self-exclusion and blocking measures

- Self-Exclusion Schemes: Formally exclude yourself from online and physical gambling platforms for a specified period (e.g., 6 months to 5 years). Services like GAMSTOP (UK) can exclude you from all UK-licensed online gambling companies

- Block Gambling Transactions: Many banks and building societies offer options to block gambling transactions.

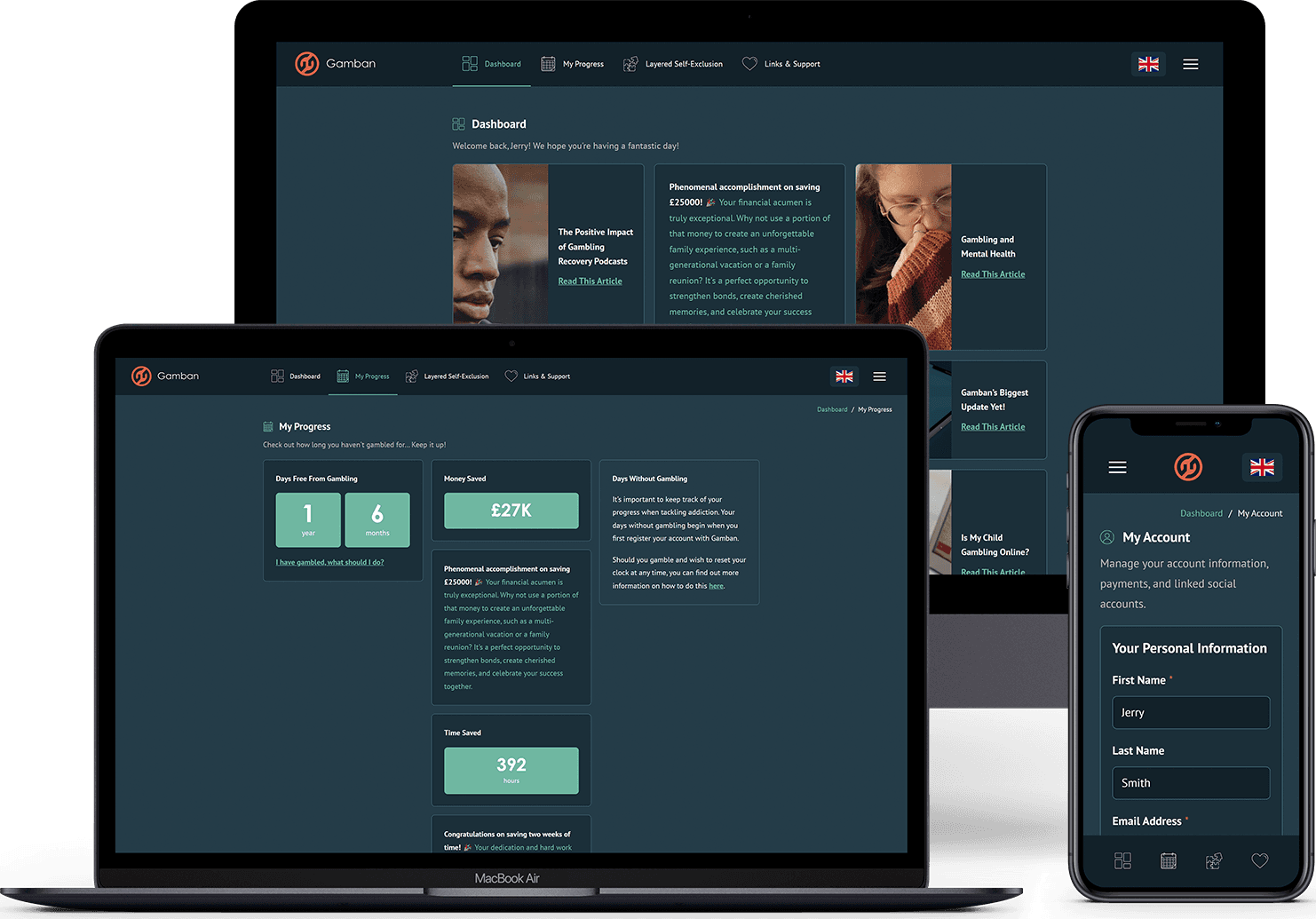

- Blocking Software: Install Gamban on all your devices to restrict access to gambling websites and apps.

Create Obstacles to Gambling and Spending

One way to help change a habit is to put obstacles in your way. Reducing access makes it harder to carry out the action.

- Remove all your credit card info from your devices and accounts, so you have to re-enter it every time.

- Put a picture of a loved one or a phrase in strategic places to remind you of your goal to pay off debt. For example, around your credit card or as your phone's wallpaper. The reminder will force you to pause, at the very least.

- Instead of using a regular credit card, opt for a prepaid credit card. This means more effort because you have to reload the card once the limit is reached.

- Put your credit cards out of reach. Lock them up somewhere, give them to a trusted friend, just get them out of easy access.

Seeking Professional Help and Support

Recognising that you need help is a sign of strength. Professional support can include guidance, emotional support and practical tools for recovery.

In many countries, there are organisations that can provide you with free guidance and support in managing your debts. For debt help options, click here.

Moving On From Gambling Debt

Overcoming gambling debt is a challenge, but it can be done. Financial strategies, actively working to stop gambling, and seeking professional and peer support will give you control of your finances and help to rebuild your life.

Remember, you are not alone, and help is available.