15/01/2026

Financial problems are often the first outward sign of a gambling disorder. When gambling becomes uncontrollable, spending often increases in an attempt to recoup losses. This creates a vicious cycle known as Loss Chasing.

Support organisations, such as GamCare, have noted that many who contact their National Gambling Helpline are also looking for financial support and advice due to their gambling or that of a loved one. If you struggle with debt because of your gambling addiction, you are not alone, and there are many organisations out there that can help you get your finances back on track.

Debt Help Organisations

Canada

Consolidated Credit Canada - Free credit counselling and the lowest cost debt management plans in Canada, visit https://www.consolidatedcreditcanada.ca/ for more information.

Call 1 (844) 538-7177 to save $25 on your setup fee.

Gamban may receive a small referral fee if you enrol, and we only work with organisations that offer safe and reputable support.

America

Gamfin - Get help managing gambling-related debt. GamFin provides free, one-on-one financial counselling, completely confidential and available in many US states.

Finland

Oikeuspalvelu Virasto - Free financial and debt advice organised by the state. Advice is provided by financial and debt advisers and legal aid secretaries. Advice is confidential and the staff are bound by a duty of confidentiality.

Norway

NAV - NAV can advise you if you’re having financial difficulties. The service is free of charge and run by the Norwegian labour and welfare administration.

Australia

National Debt Helpline - Work out what you can afford, how to negotiate payment plans, what debts to prioritise, and more.

France

CRÉSUS - CRÉSUS is a public utility association that supports people with financial difficulties, with a mission towards reducing overindebtedness. They have reception points across France.

Netherlands

Nibud - Nibud is an independent information institute. They conduct research and provide information on household finances. Nibud is a non-profit foundation.

United Kingdom

StepChange is an independent charity offering tailored advice and practical solutions to people who are in debt.

Call StepChange free on 0800 138 1111, or visit https://www.stepchange.org/ for more information.

Debt Advice Foundation is a charity offering free, impartial support to anybody worried about debt.

Visit https://www.debtadvicefoundation.org/ for more information.

The National Debtline provides free, confidential, and independent advice on dealing with debt problems.

Call the National Debtline on 0808 808 4000, or visit https://www.nationaldebtline.org/ for more information.

The Citizens Advice Bureau offer advice and support for anyone struggling with gambling debt.

Visit https://www.citizensadvice.org.uk/ for more information.

PayPlan offers 24/7 free debt advice and debt management plans.

Call PayPlan free on 0800 280 2816 (Monday-Friday 8am-8pm, Saturday 8am-4pm), or visit www.payplan.com/ for more information.

If you have been approached by someone who offered to lend you money to gamble or to cover your debts, be aware that they may be a loan shark. Find out how to report a loan shark anonymously on the GOV.UK website.

If you are self-employed or run a small business and have personal or business debts, contact Business Debtline for further advice.

Treatment and support resources can help you stop gambling, and with abstinence from gambling, the stress from financial pressures will begin to be relieved. Of course, long-term solutions will require hard work, debt repayment and careful planning, but your finances can recover over time.

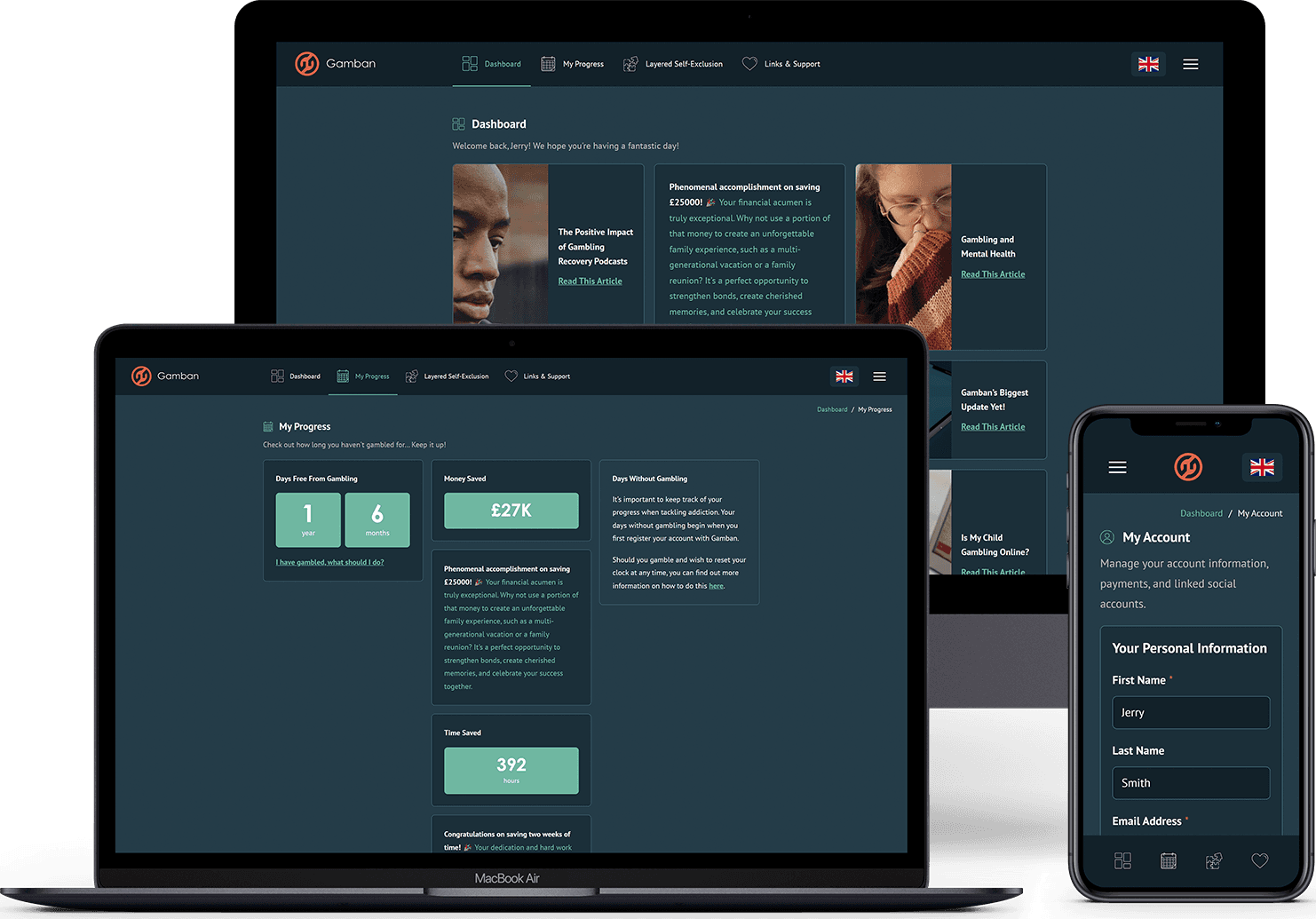

Device Blocking

Gambling Blocking software, like Gamban, can be downloaded to all your devices to restrict access to thousands of worldwide gambling websites and apps. Gamban can be accessed for free in the UK through TalkBanStop.

Self-Exclusion

Self-exclusion usually includes, for example, asking a gambling company, casino or betting shop to exclude you from playing with them for a given period of time. It ensures you will be denied online and offline service at the locations from which you are self-excluded. Gambling operators in the UK are required by regulation to provide self-exclusion.

Transaction Blocking

Banks such as Monzo, Lloyds and Starling now allow customers to block gambling transactions on their bank accounts or credit cards. Offering users another method to abstain from online gambling.