12/08/2025

Whether it’s buying a lottery ticket, betting on a big match or playing online slots, many of us have gambled at some point in our lives. A little over £14 billion was spent on gambling in the UK last year, with more than 420,000 gamblers in Britain losing at least £2,000 a year, 3.1% of UK gamblers having bet more than they can afford to lose, and 7% of gamblers saying they did so as a way to “earn money to get by day-to-day”.

Using gambling as a way to get your hands on a bit more money may sound appealing, but the odds of it working out that way make it virtually impossible in the long run. Gambling should never be used as a way to make money, as it can very quickly spiral out of control. Chasing a bigger win, or upping your bet to make back what you’ve lost are common traits that lead to losses spiralling out of control.

How Much Do I Spend?

When it comes to gambling, it's easy to lose track of how much you're spending, especially when caught up in the excitement of it. Everyone spends a different amount, but it’s important to work out exactly how much you are spending.

Take a long hard look at your finances, how much have you spent on gambling in total? Do you gamble regularly? In that case, how much do you spend on average? Do you set yourself limits?

GambleAware offers a tool to help you calculate your true gambling cost, which might help put your spending into perspective. Find out more here: https://www.begambleaware.org/spend-calculator

If you find that you're struggling to control your spending, that could be a sign you're developing an addiction.

How Much Is Too Much?

While there is no one-size-fits-all answer to “How Much Is Too Much?”, it’s important to know your limits. If you’re unable to pay for bills, rent, basic amenities, or even to afford certain luxuries, that’s a sign you may be spending too much on gambling.

If your gambling gets in the way of what you really want, you’re spending too much. If you’ve forgotten how to enjoy something other than gambling, it might be time to reconsider your relationship with it.

The Financial Consequences of Gambling Addiction

Financial consequences can include accumulating debt, using money intended for other essential expenses such as bills, and financial hardship. If you are spending more than you can afford, you may find yourself in a situation where you cannot meet your financial obligations, which can lead to stress, anxiety, and even legal issues. Below, we go into more detail about the possible situations some may find themselves in.

Debt

Gambling addiction can lead to mounting debts as some may use credit cards, loans or borrow from friends and family to finance their gambling. This could result in financial ruin, damaged credit score and even bankruptcy.

Loss of savings

Some may even use their savings or retirement funds to finance their gambling, leaving them with little or no savings for emergencies or retirement.

Job loss

Gambling addiction may cause some to miss work, be late, or to perform poorly due to the effects of gambling, and could lead to them losing their job.

Gambling addiction can have devastating effects that go beyond just financial loss. Individuals who struggle with gambling addiction may experience negative impacts on their self-esteem, physical and mental health, and relationships with others. The consequences of gambling addiction can be far-reaching and may affect not only you but also those around you.

Breaking the Cycle of Overspending

The first step is to acknowledge that you have a problem with overspending on and over-engagement with gambling. This can be difficult, but it is important to be honest with yourself. Many people find themselves in this position, so you are not alone.

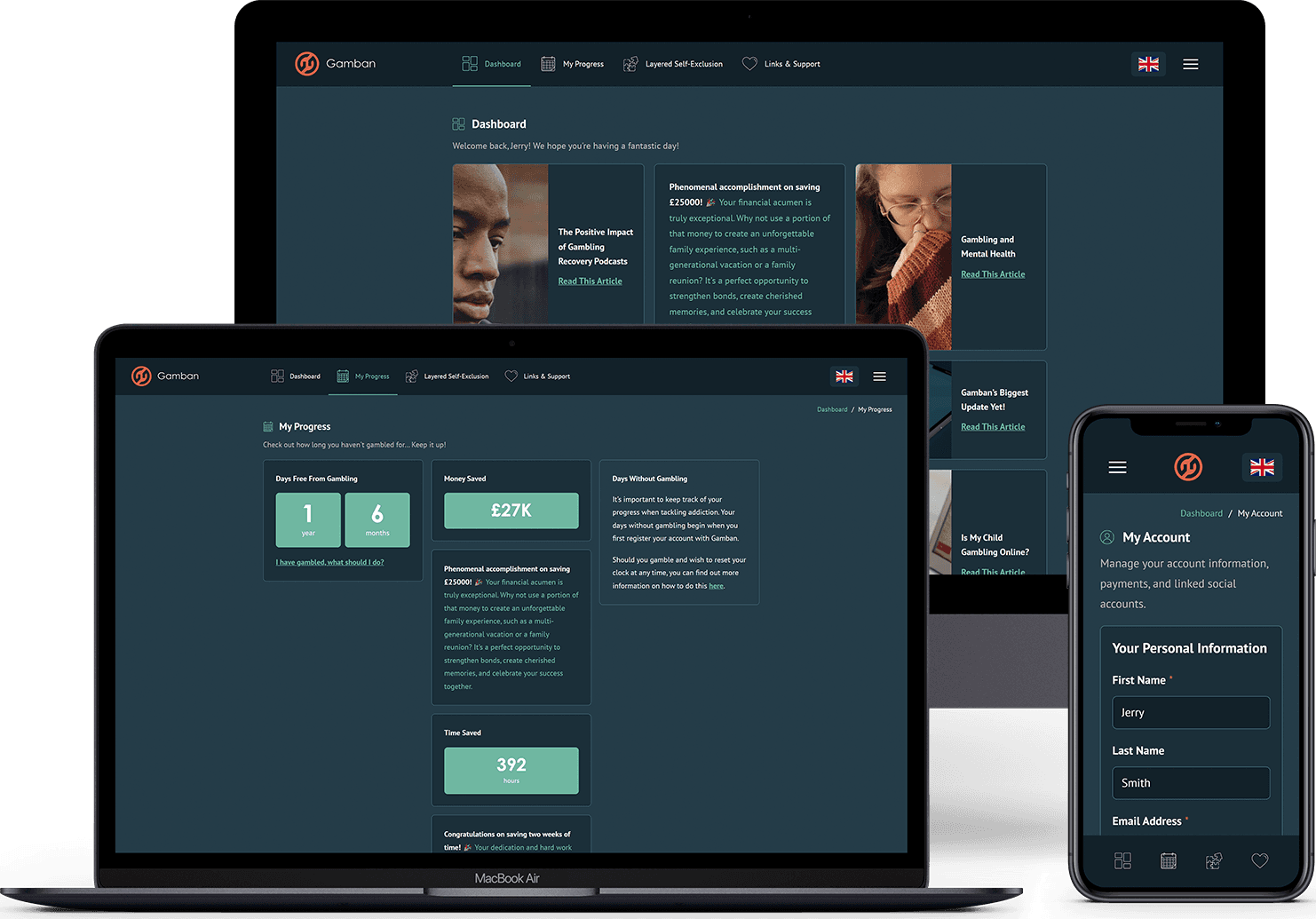

The best thing you can do for yourself moving forward is to avoid the temptation to gamble. Gamban is one option to help you abstain from all online gambling, blocking your devices, to give you the peace of mind of knowing that even if you wanted to gamble on your smartphone or computer, you can’t.

It’s also important to find support. Whether that’s someone close to you, a trusted family member, a close friend or spouse. You could even reach out to others like you on online forums or gambling support groups, such as GamCare’s: https://www.gamcare.org.uk/forum/

Are you struggling with debt because of your gambling? You are not alone. There are many organisations out there that can help you get your finances back on track. Find out more about these organisations here.